Rachel Reeves is expected to unveil pension reforms this week which are intended to channel money into infrastructure and private businesses.

The Chancellor is also expected to use her first Mansion House speech in the City of London to “spell out the next phase” of Labour’s plan in Government, after her key pledge in October’s Budget to “fix the foundations” of the economy.

Her speech on Thursday will come against a backdrop of criticism from the hospitality sector, including signatories to a letter organised by UKHospitality who warned that changes to employers’ national insurance contributions could lead to job losses.

Our Chief Executive @UKHospKate has written to the Chancellor, alongside more than 200 leading hospitality businesses, to warn that changes to employer NICs will cause small business closures, job losses and cancelled investment.

Read more here 👇https://t.co/3yhDhVU9Qi

— UKHospitality (@UKHofficial) November 10, 2024

Launching her pension changes, which Treasury sources have said could unlock billions of pounds for critical infrastructure and businesses, Ms Reeves will pitch “growth brought by unlocking private sector investment, including in our financial services industry, and growth brought about by reform – both of our economy and of our public services”.

The Chancellor is also expected to highlight “the untapped potential we have here in Britain, the opportunities available that can be realised, the partnerships that can be forged, the wealth that can be created” as “the prize on offer”.

This could include partnerships with economies in Europe, the Middle East, Asia and the US, the PA news agency understands.

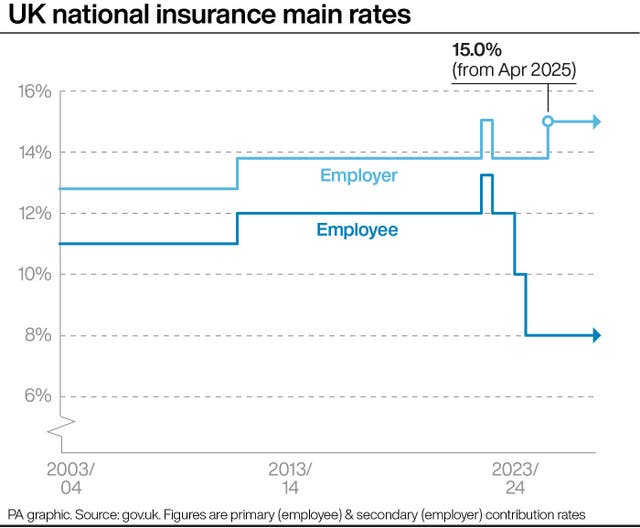

At last month’s Budget, Ms Reeves unveiled a change to the amount employers pay in national insurance contributions (NICs), expected to raise more than £25 billion for the Treasury.

As well as an increase in the rate employers pay from 13.8% to 15%, the threshold at which employers start paying the tax will be reduced from £9,100 per year to £5,000.

But in a letter on Sunday, 14 UKHospitality board members and a further 209 businesses, including JD Wetherspoon, IHG Hotels and Resorts and restaurant chain Tortilla, have warned that “changes to the NICs threshold are not just unsustainable for our businesses, they are regressive in their impact on lower earners and will impact flexible working practices which many older workers and parents rely upon”.

They continued: “Unquestionably they will lead to business closures and job losses within a year.

“The threshold change brings many team members into employer NICs for the first time. We estimate the threshold change may be four times the cost of the new headline rate.

“There is no capacity to pass the costs onto customers. Businesses would be reluctantly forced to raise prices by 6-8%, fuelling inflation, yet could not realistically do so as our customers are at the end of their ability to pay more.

“Instead, many businesses would have to reconsider investment and drastically cut jobs and reduce the hours of team members.”

The letter read: “We know you are determined to ensure that growth is available to all.

“Yet this change to NICs does the opposite, balancing the books on the backs of the businesses which provide jobs to all in society, nationwide, while sparing businesses that used technology to shed jobs.”

They have suggested Ms Reeves rolls out a new NICs band between the new £5,000 and old £9,100 thresholds – with a lower 5% rate – or an exemption for lower band taxpayers who work fewer than 20 hours per week, to support workers in part-time and lower paid roles.

The concerns from the hospitality industry come after retailers also raised questions about the impact of the NICs rises last week.

Asked about complaints from businesses such as retailers about the changes to NICs, Treasury minister Darren Jones told the BBC: “I think the public would recognise that bigger businesses are more able to burden some of the contributions that we need to make to the state and actually getting the NHS back on its feet so workers who are off sick can get back to work is probably something that retailers will benefit from as well as all the other measures that we’ve put forward in the Budget.”

Asked if that means it is “tough” for big businesses, Mr Jones said: “There are measures more broadly in the Budget which we think are good for business, good for growth and good for the economy, but on tax contributions, yes it’s been designed in that way.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel